Embark on a journey towards wealth accumulation with our comprehensive guide. Learn the essential strategies and techniques to proficiently manage your finances, nurture healthy money habits, and achieve long-term success.

You may be a beginner just starting out or an experienced investor looking to enhance your portfolio, this guide provides invaluable knowledge to help you take control of your financial well-being.

- Explore the fundamentals of budgeting, saving, and investing.

- Comprehend the importance of credit management and debt reduction.

- Gain a clear roadmap to fulfill your goals.

Building a Solid Financial Foundation

Creating a robust financial foundation lays the bedrock of future success. This involves implementing sound financial practices, cultivating disciplined spending habits, and strategically investing your own. A solid foundation offers a sense of confidence, enabling you to navigate financial read more fluctuations with assurance.

- Start by establishing a comprehensive budget that tracks your income and expenses.

- Pinpoint areas where you can cut back spending and direct those funds toward savings.

- Investigate different investment options that align with your risk tolerance.

Investing for Long-Term Wealth Creation

Securing your financial future necessitates a strategic approach to wealth building. Long-term wealth creation comes from consistent and strategic portfolio management. This means carefully choosing assets with the potential for increase over time. It also demands a patient approach, accepting market fluctuations and rebalancing your portfolio as needed.

By cultivating these principles, you can position a solid path toward achieving your long-term wealth aspirations.

Securing Financial Freedom

The path to financial freedom can be rewarding, but it's a desire worth pursuing in. It involves a blend of discipline and calculated {planning|. To begin, take your current financial standing. Assess your revenue, expenditures, and obligations. Then, formulate a budget that assigns your assets wisely.

- Discover wealth-building opportunities that suit your appetite and retirement objectives.

- Cultivate a solid reputation. This can provide access to lower interest rates on mortgages.

- Inform yourself about personal finance strategies. There are many tools available, such as books, to deepen your knowledge.

Bear this in mind that financial freedom is a journey, not a instant result. Stay committed on your goals and acknowledge your milestones along the way.

Smart Spending Habits for Lasting Achievement

Building a secure financial future requires more than just earning a good income. It necessitates cultivating smart spending habits that pave the way for lasting success. Discipline in your expenditures can help you achieve your financial goals, whether it's saving for retirement, purchasing a home, or simply enjoying peace of mind. Initiate by tracking your expenses to identify areas where you can reduce. Embrace budgeting tools and techniques to allocate your funds effectively. Remember, smart spending isn't about deprivation; it's about making thoughtful choices that support your values and priorities.

By prioritizing needs over wants, negotiating for better prices, and planning for large purchases, you can maximize the value of every dollar you spend.

Unlocking Your Wealth Potential

Have you ever desired to realize your full capitalistic potential? It's a journey that begins with grasping the power of your actions. By cultivating smart habits, you can unlock a world of possibilities. Begin by creating a solid budget. This will offer you a clear overview of your income and expenditures. From there, you can wisely distribute your resources to maximize your success. Remember, financial freedom is not just about accumulating wealth, it's also about living a meaningful life.

Scott Baio Then & Now!

Scott Baio Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Atticus Shaffer Then & Now!

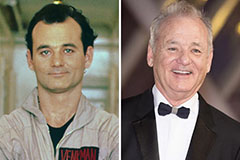

Atticus Shaffer Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!